CSP Insights

Your go-to source for the latest in news and information.

Forex Frenzy: Riding the Waves of Currency Chaos

Dive into Forex Frenzy! Uncover secrets to profit amidst currency chaos and ride the waves to financial success. Don't miss out!

Understanding Forex Market Dynamics: A Beginner's Guide

Understanding Forex Market Dynamics: A Beginner's Guide

The Forex market, also known as the foreign exchange market, is a decentralized global marketplace where currencies are traded. As a beginner, it's crucial to grasp the fundamental dynamics that influence currency values, including economic indicators, geopolitical events, and market sentiment. Understanding these factors can provide valuable insights into market movements. For further reading on economic indicators, consider visiting Investopedia to explore their impact on Forex trading.

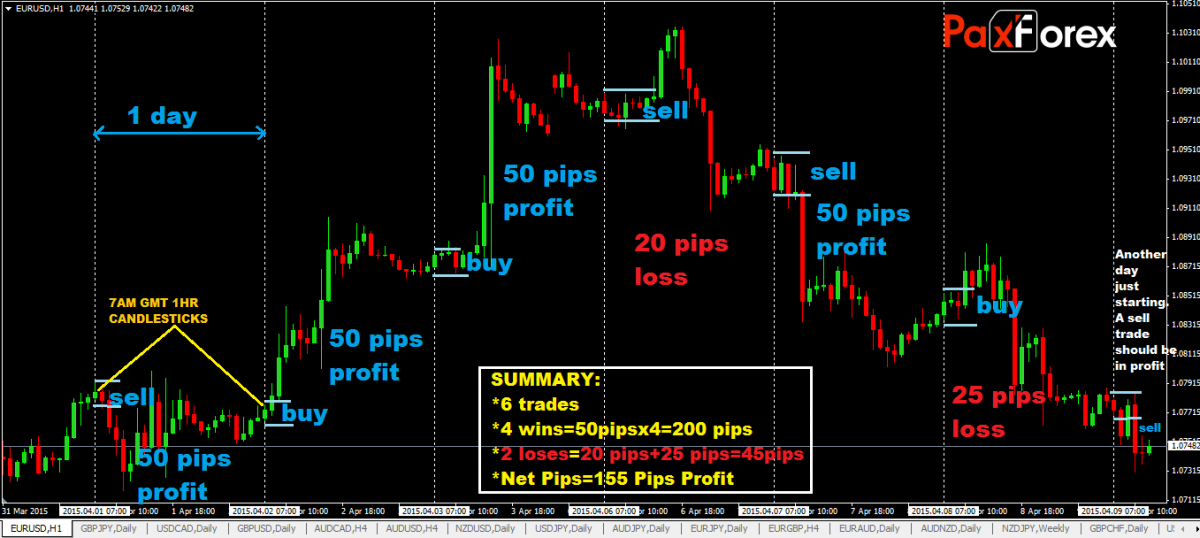

Moreover, gaining familiarity with trading strategies is essential for navigating the Forex market effectively. Beginners can choose from various strategies, such as day trading, swing trading, or trend following. Each approach has its own set of risk profiles and reward potentials. To delve deeper into these strategies, you may want to explore resources like Forex Factory which offers a community-based platform for trading ideas and discussions.

Top 5 Strategies for Navigating Currency Volatility

Currency volatility can significantly impact businesses and investments. To manage this risk, it's essential to implement effective strategies. Here are the top five strategies for navigating currency volatility:

- Diversification: Shield your portfolio by investing in different currencies or assets, which can help reduce exposure to any single currency's fluctuations. For more insights on diversification, check out Investopedia.

- Hedging: Use financial instruments such as options or futures to lock in exchange rates, providing a safety net against unfavorable movements. Learn more about hedging strategies from Forbes.

- Stay Informed: Keep track of economic indicators and geopolitical events that could influence currency values. For daily updates, visit Bloomberg's Currency Market.

- Local Currency Accounts: Consider maintaining local currency accounts to minimize conversion costs and bypass some volatility. More about this approach can be found at Business News Daily.

- Seek Expert Advice: Engage with financial advisors or currency specialists to develop personalized strategies tailored to your risk tolerance and investment goals. Find a qualified expert through NAPFA.

How to Manage Risk in Forex Trading: Tips and Best Practices

Managing risk in forex trading is crucial for long-term success. One of the most effective strategies is to establish a risk-reward ratio for each trade you make. A common approach is to aim for a minimum ratio of 1:2, meaning that for every dollar you risk, you should aim to make at least two dollars. This strategy helps to ensure that even if you face a few losing trades, your profitable trades will cover those losses and contribute to overall gains. Additionally, utilizing stop-loss orders can limit potential losses on any given trade, allowing for a more disciplined approach to trading.

Another essential best practice in managing forex trading risk is to diversify your portfolio. Rather than putting all your capital into a single currency pair, consider spreading your investments across multiple pairs that may respond differently to market conditions. This diversification reduces the chance of significant losses as not all trades will move in the same direction simultaneously. Furthermore, keeping abreast of global economic news through resources like Bloomberg Markets can provide valuable insights that impact currency fluctuations, helping you make informed decisions that align with your risk management strategy.