CSP Insights

Your go-to source for the latest in news and information.

Climbing the Cashback Ladder: How Loyalty Tiers Reward Your Wallet

Unlock the secrets of loyalty tiers and elevate your savings! Discover how climbing the cashback ladder can supercharge your wallet today!

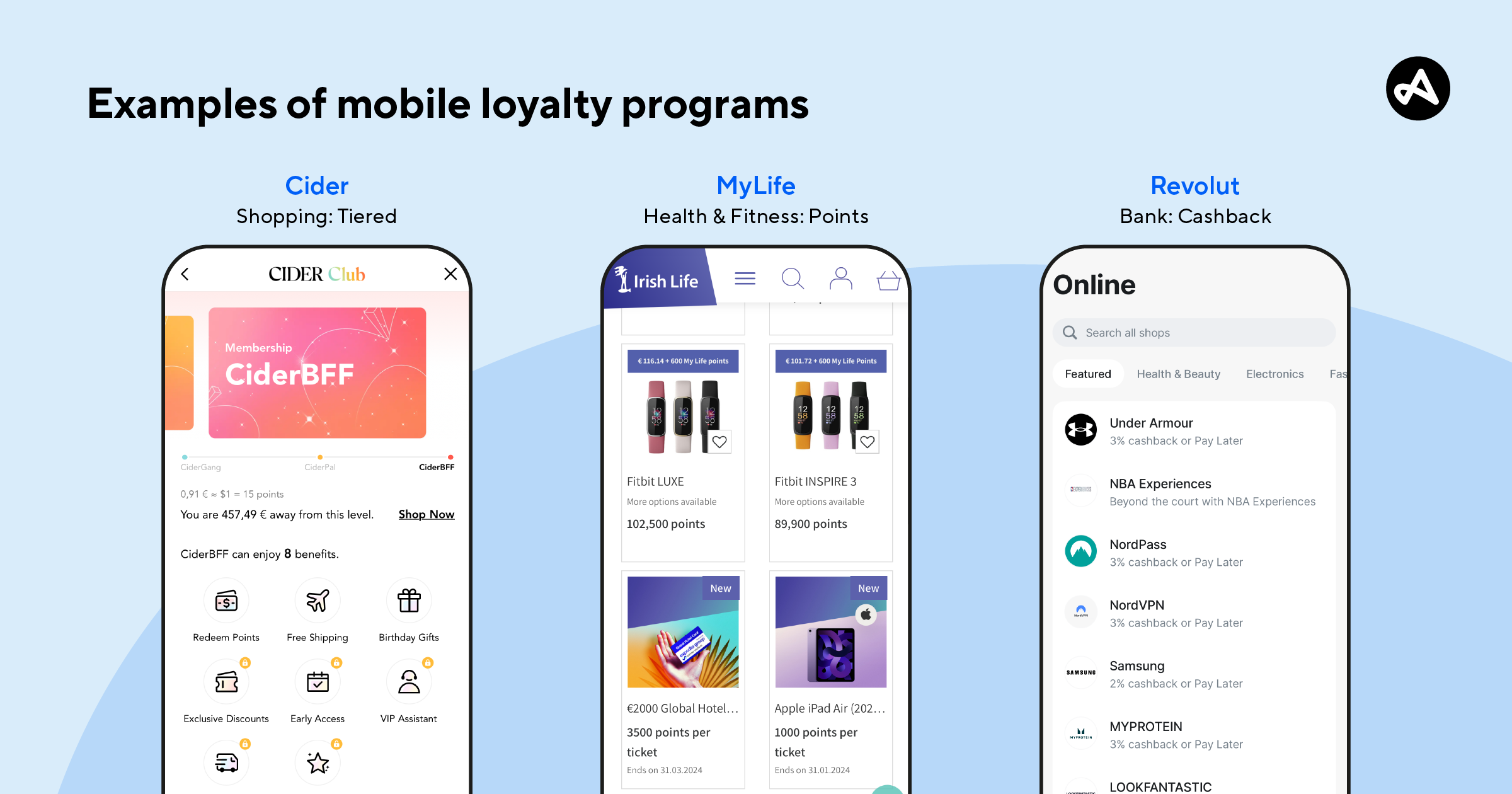

Understanding Loyalty Tiers: How Cashback Rewards Increase with Your Spend

Understanding Loyalty Tiers is essential for maximizing the benefits of cashback rewards programs. Many retailers and financial institutions utilize a tiered system to encourage customers to spend more, rewarding them with increasing benefits as they reach higher tiers. For instance, a typical structure might start with a basic tier where users earn a minimum cashback rate on their purchases, progressing to premium tiers that offer higher percentages of cashback on every dollar spent. As consumers climb these tiers, they not only enjoy better cashback rates but also gain access to exclusive promotions, discounts, and personalized offers.

To take full advantage of these loyalty programs, it's crucial to understand how your spending habits can impact your cashback rewards. Cashback rewards often increase significantly as you move up the tiers. For example, a customer in the bronze tier might earn 1% cashback, while in the silver tier, they could earn 1.5% and in the gold tier, 2% or more. This tiered approach creates a strong incentive for customers to spend more in order to unlock better rewards, making it beneficial to evaluate how additional spending can translate into more significant cashback returns over time.

Counter-Strike is a popular first-person shooter game that has captured the hearts of gamers worldwide. Players can engage in intense team battles, where strategy and skill are crucial for success. If you're looking to enhance your gaming experience, consider using a clash promo code to unlock exciting features and benefits.

Maximizing Your Earnings: Strategies for Climbing the Cashback Ladder

Maximizing your earnings through cashback programs can significantly enhance your financial strategy. To effectively climb the cashback ladder, it's essential to start by choosing the right cards. Look for credit cards that offer high reward rates on your most frequent purchases, such as groceries, gas, or online shopping. Additionally, consider cards with rotating categories that provide bonus cashback. Regularly review your spending patterns to ensure you're using the most rewarding options available, enabling you to accumulate cashback rewards faster.

Another effective strategy is to leverage cashback apps and websites. By linking these platforms to your online shopping habits, you can earn cashback on purchases made through various retailers. Don’t forget to stack your savings by combining cashback from your credit card with the offers provided by these apps. Additionally, participating in promotions, referring friends, and keeping an eye out for double cashback events can help you maximize your earnings even further. Remember, the key to climbing the cashback ladder is consistency and strategic planning.

Are Loyalty Programs Worth It? Evaluating the True Value of Cashback Tiers

Loyalty programs have become increasingly popular among consumers, often promising enticing rewards and cashback benefits. However, the true value of these programs can vary significantly based on individual spending habits and the program's structure. For many, the allure of cashback tiers can lead to deeper customer engagement, but it's essential to evaluate whether the benefits truly outweigh the potential costs. Factors such as membership fees, expiration of points, and the likelihood of reaching higher tiers play a crucial role in determining the overall worth of a loyalty program.

When assessing the effectiveness of a loyalty program, consider the following key points:

- Analyze your spending patterns to see if they align with the program's rewards.

- Calculate the potential cashback you could earn versus any associated costs.

- Evaluate any limitations or restrictions on redeeming rewards that might diminish the perceived value.